TAX COURSE OVERVIEW

You're now part of a powerful, recession-proof industry where knowledge truly equals income. Whether you’re here to earn extra money, build your own tax firm, or develop a high-demand skill, this course is your starting point. Together, we’ll turn your potential into profit—one tax return at a time.

Whether you're a business owner, investor, or just looking to improve your financial literacy, this program equips you with the tools and knowledge to navigate taxes with confidence.

Student Portal Access

Please bookmark your student login for easy access to all training materials, practice returns, and class replays:

https://stephanie-crutchfield-s-school1.teachable.com/

You should have received a welcome email from our school platform. This portal is your hub for everything you need during the course.

What This Course Covers

Everything You Need to Succeed

This course gives you the tools to become a confident tax preparer. You’ll learn:

- Filing statuses and tax forms

- Credits and deductions clients often miss

- Schedule C and self-employment income

- Due diligence and tax ethics

- IRS rules, compliance, and audit protection

- Client service, marketing, and growth strategies

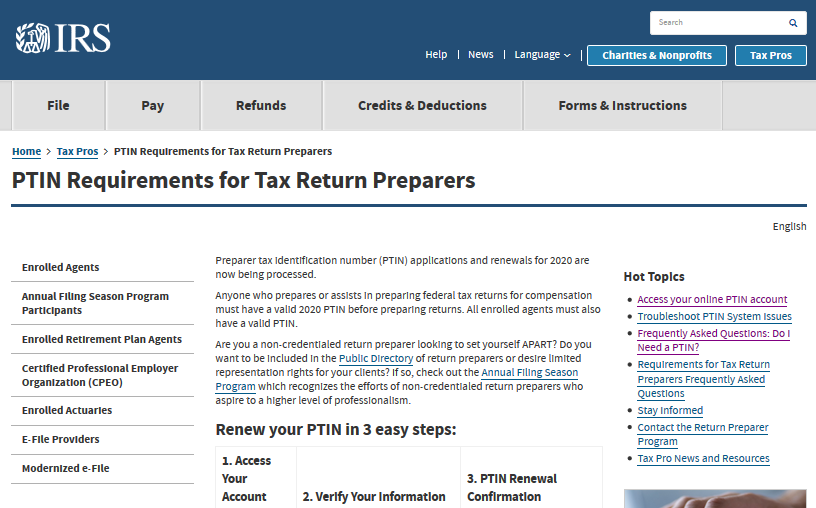

From PTIN to Pro

Step-by-Step Professional Setup

We’ll guide you from setup to success. You’ll learn how to:

- Apply for your Preparer Tax Identification Number (PTIN)

- Understand Form 1040 and common schedules

- Reconstruct income from bank statements or gig work

- Stay compliant with IRS regulations

- Get familiar with tax software for real-world use

Practice Makes Profit

Hands-On Training That Prepares You for Clients

You won’t just learn theory—you’ll get real practice:

- Complete mock tax returns

- Take quizzes to reinforce key concepts

- Use cheat sheets and guides to save time

- Practice real scenarios using scripts and answer keys

- Earn your Certificate of Completion when you finish

Due Diligence = IRS Protection

Stay Audit-Proof and Penalty-Free

Following IRS due diligence rules protects your clients and your business. We’ll show you how to:

- Document Head of Household and dependent claims

- Properly report self-employment income

- Maintain audit-ready client files

- Avoid costly mistakes and IRS penalties

Marketing Like a Tax Boss

Learn How to Attract & Retain Clients

Tax skills are just part of the business; you also need clients. We teach you how to:

- Build your brand and online presence

- Use social media to attract paying clients

- Run webinars, info sessions, and tax Q&As

- Set up referral programs to grow your reach

- Launch a mobile or virtual tax office from home

Behind the Scenes of a Tax Office

Tools, Tech, and Back-End Setup

A smooth operation starts with the right systems. You’ll learn:

- How to apply for your EFIN (Electronic Filing ID Number)

- What tax software fits your needs

- How to set up your office, physical or virtual

- Best practices for client intake, contracts, and WISP compliance

- How to keep accurate records and run efficiently

Beyond the Basics

Take Your Tax Career to the Next Level

This course opens doors to more than just tax prep. Learn how to:

- Train others and build a tax team

- Add services like bookkeeping, audit protection, and credit repair

- Start a scalable mobile or virtual tax business

- Become an ERO (Electronic Return Originator) and mentor new preparers

Let’s Get You Certified & Paid

Graduate With Confidence and a Plan

Once you complete this course:

- You’ll receive your Certificate of Completion

- Be fully equipped to prepare and file tax returns

- Know how to onboard and serve your first clients

- Get access to support groups and mentorship

- Be ready to start earning right away!